san francisco payroll tax calculator

ASR Tax Financial Services. Ad Process Payroll Faster Easier With ADP Payroll.

New Tax Law Take Home Pay Calculator For 75 000 Salary

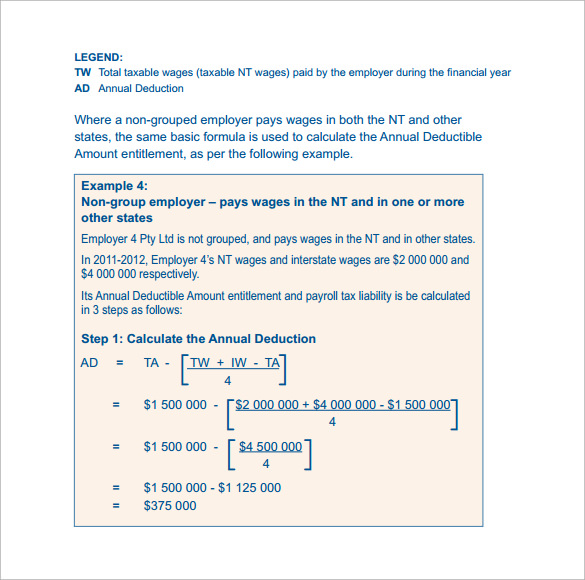

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their.

. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare. From imposing a single payroll tax to adding a gross receipts tax on. All Services Backed by Tax Guarantee.

The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. Payroll Expense Tax. Although this is sometimes conflated as a personal income tax rate the city only.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their. Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation. Name A - Z Sponsored Links.

Ad Compare This Years Top 5 Free Payroll Software. Find The Best Payroll Software To More Effectively Manage Process Employee Payments. If you make 55000 a year living in the region of California USA you will be taxed 11676.

Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. Get Started With ADP Payroll. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

That means that your net pay will be 43324 per year or 3610 per month. Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Proposition F fully repeals the.

Payroll Expense Tax. Name A - Z Sponsored Links. Calculations of 2022 estimated quarterly business tax payments will be based on the information entered in your San Francisco Annual Business Tax Return for 2021 and will be displayed in.

Intelligent user-friendly solutions to the never-ending realm of what-if scenarios. Get Started With ADP Payroll. Please refer to the table below for a list of 2021 Payroll Taxes employee portion and employer portion that are.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Discover ADP Payroll Benefits Insurance Time Talent HR More. 2022 Payroll Table Active Contracts Multi-Year Spending Positional Spending Financial Summary.

Gross Receipts Tax GR Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxesThe Tax. Discover the payroll service youve been.

California unemployment insurance tax. Youll pay this state unemployment insurance tax on the first 7000 of each employees wages each yearup to 434 per employee in 2019. State Disability Tax provides temporary funding for non-work related disabilities as well as paid family leave for those caring for an ill family member or bonding with their newborn.

Free Unbiased Reviews Top Picks. Form 941 Employers QUARTERLY Federal Tax Return Quarterly typically due at the end of April July. Your employer withholds a 62 Social Security tax and a.

Important note on the salary paycheck calculator. San Francisco 2021 Payroll Tax - 2021 California State Payroll Taxes. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad Process Payroll Faster Easier With ADP Payroll. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

This provision does not apply to annual earnings in excess of 123000. Payroll Tax Calculator in San Francisco CA. Our payroll tax services are available in and around the California Bay Area North Bay South Bay and East bay including San Francisco.

Proposition F fully repeals the Payroll Expense. Use the Free Paycheck Calculators for any gross-to-net calculation need. Payroll Tax Calculator in South San Francisco CA.

This and many other detailed reports are available with your secure login to Time2Pay.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

/buying-vs-renting-san-francisco-bay-area-ADD-V2-d0efaf2b7ac346bbba2c1ac389751ef1.jpg)

Buying Vs Renting In San Francisco What S The Difference

/buying-vs-renting-san-francisco-bay-area-ADD-V2-d0efaf2b7ac346bbba2c1ac389751ef1.jpg)

Buying Vs Renting In San Francisco What S The Difference

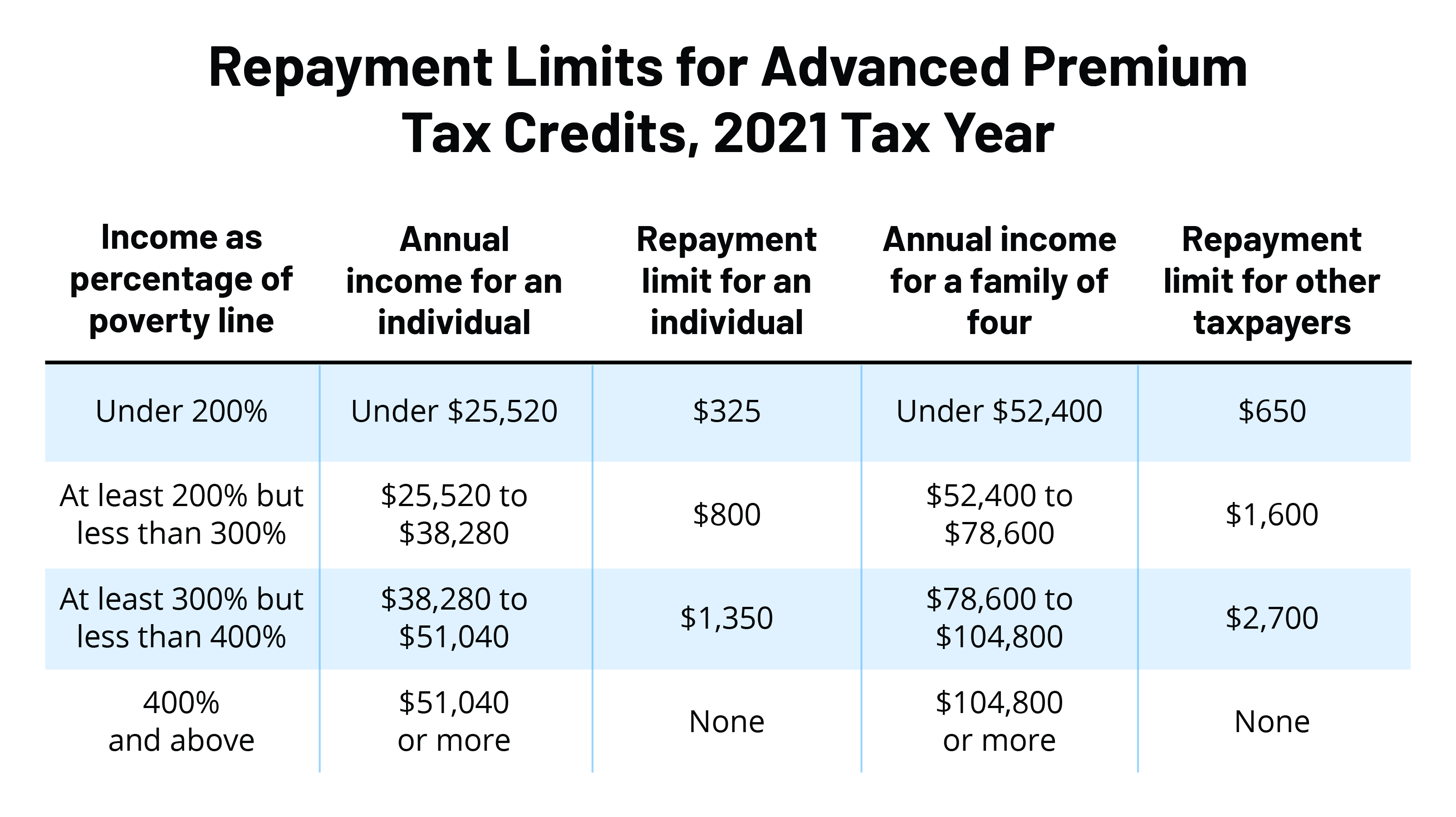

What S The Most I Would Have To Repay The Irs Kff

Why San Francisco Is In Trouble 19 000 Highly Compensated City Employees Earned 150 000 In Pay Perks

Is Vancouver A More Expensive Place To Live Than San Francisco Quora

California Paycheck Calculator Smartasset

1099 Tax Rate For 2022 And 5 More 1099 Worker Tax Tips Stride Blog

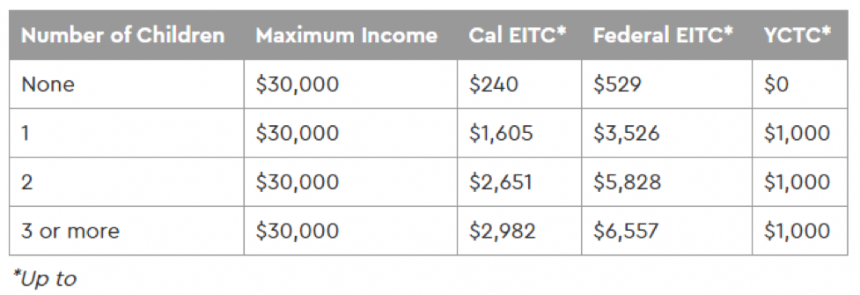

California S Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

Free Income Tax Preparation For San Francisco Residents San Francisco Ca Patch

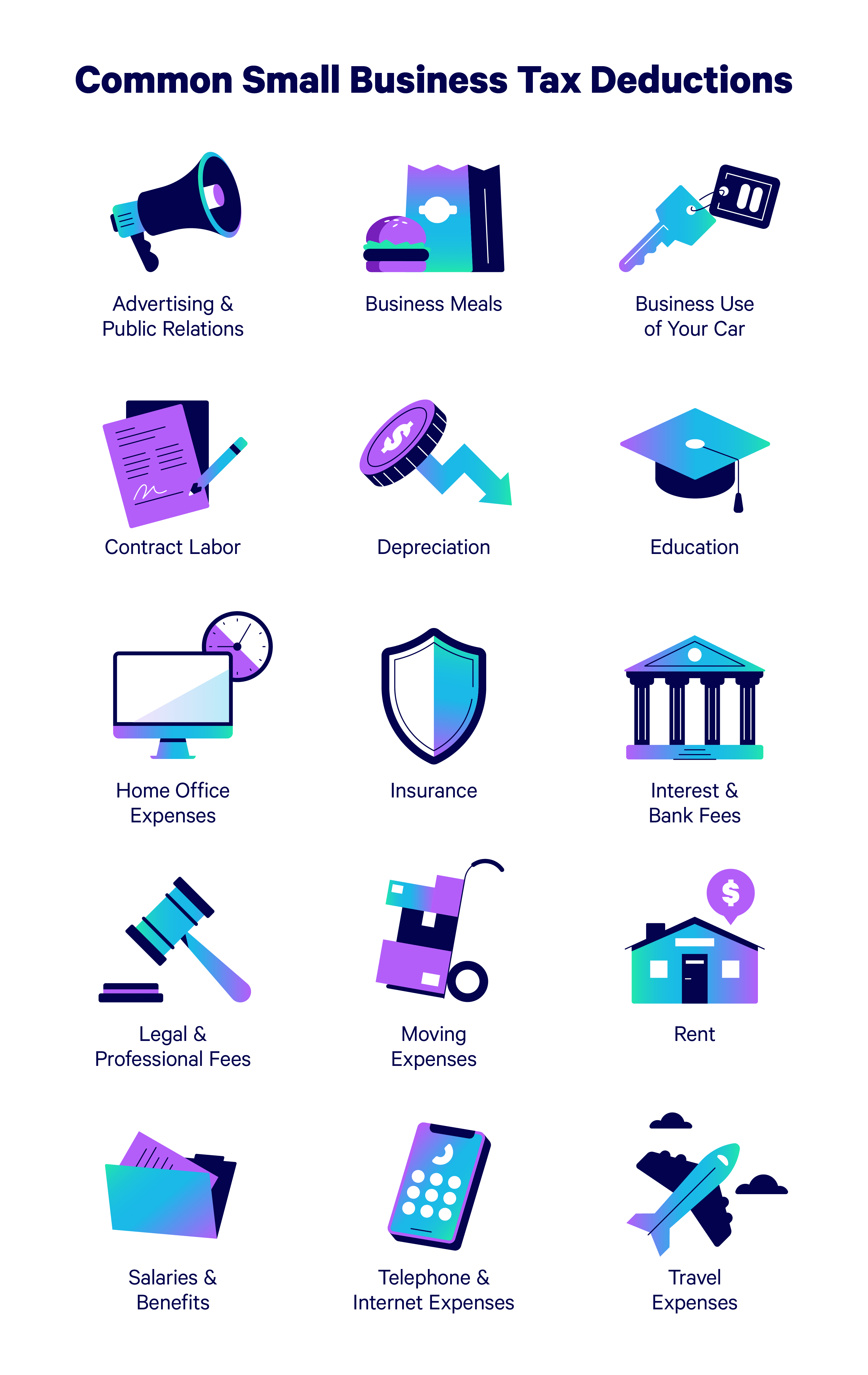

Free Llc Tax Calculator How To File Llc Taxes Embroker

Should You Move To A New City To Increase Your Income Four Pillar Freedom

Paycheck Calculator Take Home Pay Calculator

2022 Federal State Payroll Tax Rates For Employers

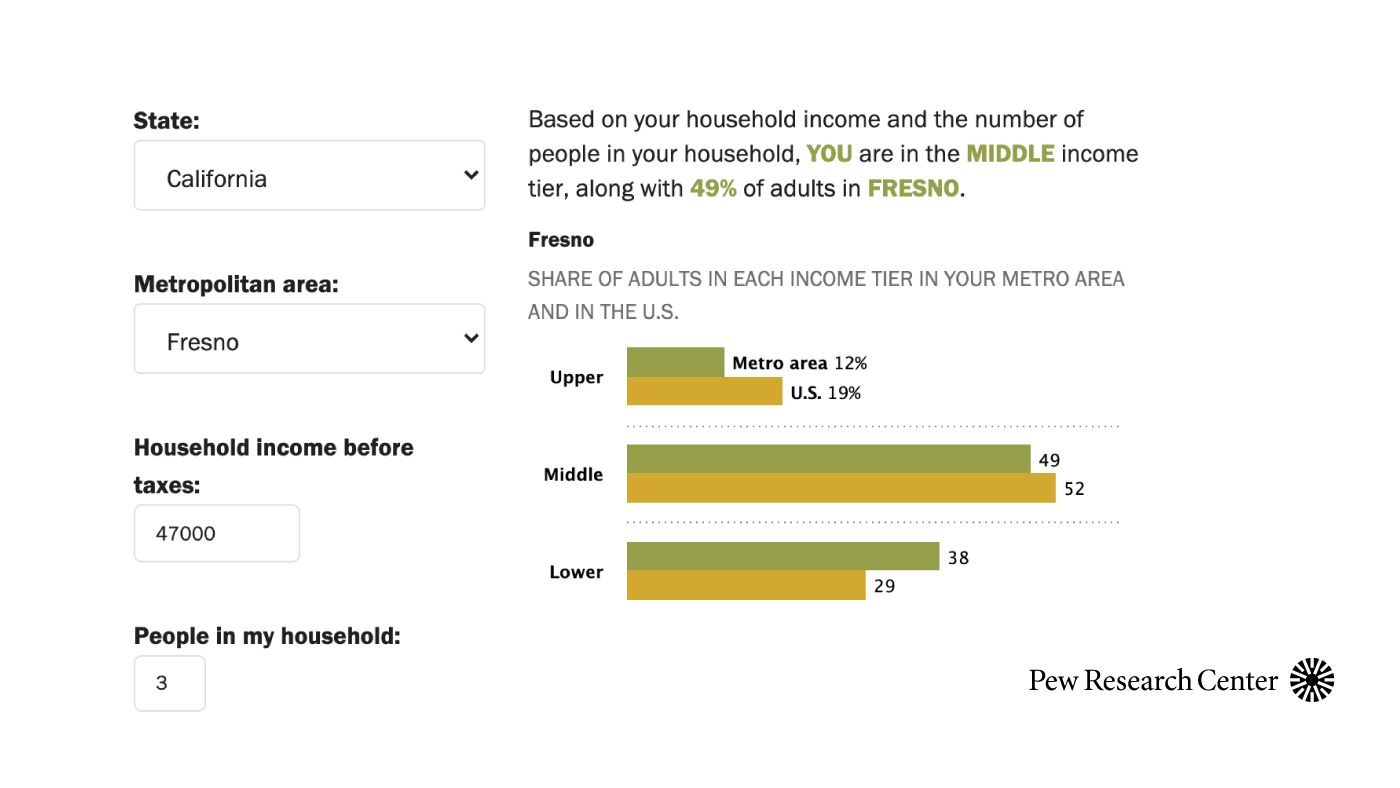

Are You In The U S Middle Class Try Our Income Calculator Pew Research Center

Free Income Tax Calculi X Chegg Com

What Do Nfl Players Pay In Taxes Smartasset

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube